What Is Dwelling Coverage?

Dwelling Coverage is the part of your Texas homeowners insurance policy that protects the physical structure of your home. This includes:

-

The walls, floors, and roof

-

Built-in appliances and cabinetry

-

Attached structures like a garage or deck

Think of it as the shield for your home’s bones and framework.

What Does It Cover?

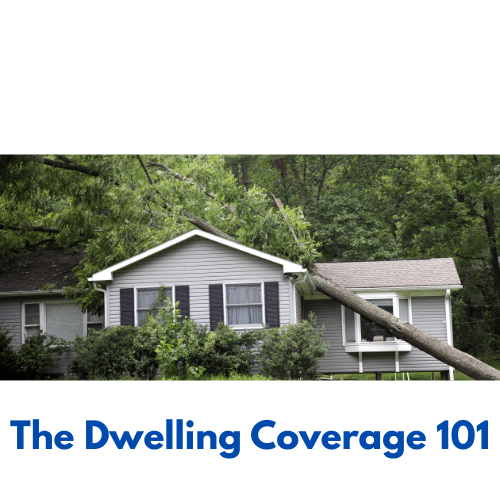

Dwelling Coverage helps pay to repair or rebuild your home if it’s damaged by a covered peril, such as:

-

Fire or smoke damage

-

Windstorms and hail

-

Lightning strikes

-

Vandalism

-

Explosions

However, it does not cover flooding or earthquakes—those require separate policies.

How Is Coverage Amount Determined?

Your Dwelling Coverage should equal the full cost to rebuild your home, not the market value.

Two methods determine your payout:

-

Replacement Cost – Pays to rebuild your home without depreciation.

-

Actual Cash Value – Pays the depreciated value of your home at the time of loss.

Most Texas homeowners choose Replacement Cost for maximum protection.

Example: Why It Matters

Imagine a fire damages your home’s kitchen and roof. Repairs could cost $150,000 or more. Without enough Dwelling Coverage, you’d be paying thousands out of pocket. With the right coverage, your insurance helps cover those costs so you can focus on getting life back to normal.

Common Mistake: Not Updating Your Coverage

Building costs in Texas have gone up. If your policy hasn’t been updated in years, you may be underinsured. Don’t wait until disaster strikes—review your limits regularly.

Final Thoughts

Dwelling Coverage is the backbone of your Texas homeowners insurance policy, and it deserves your attention.

Ready to make sure your home is fully protected?

Contact Tony Castle – Your Not So Common Insurance Agent today for a free, no-obligation policy review.

👉 Visit mytexascoverage.com or call us now!